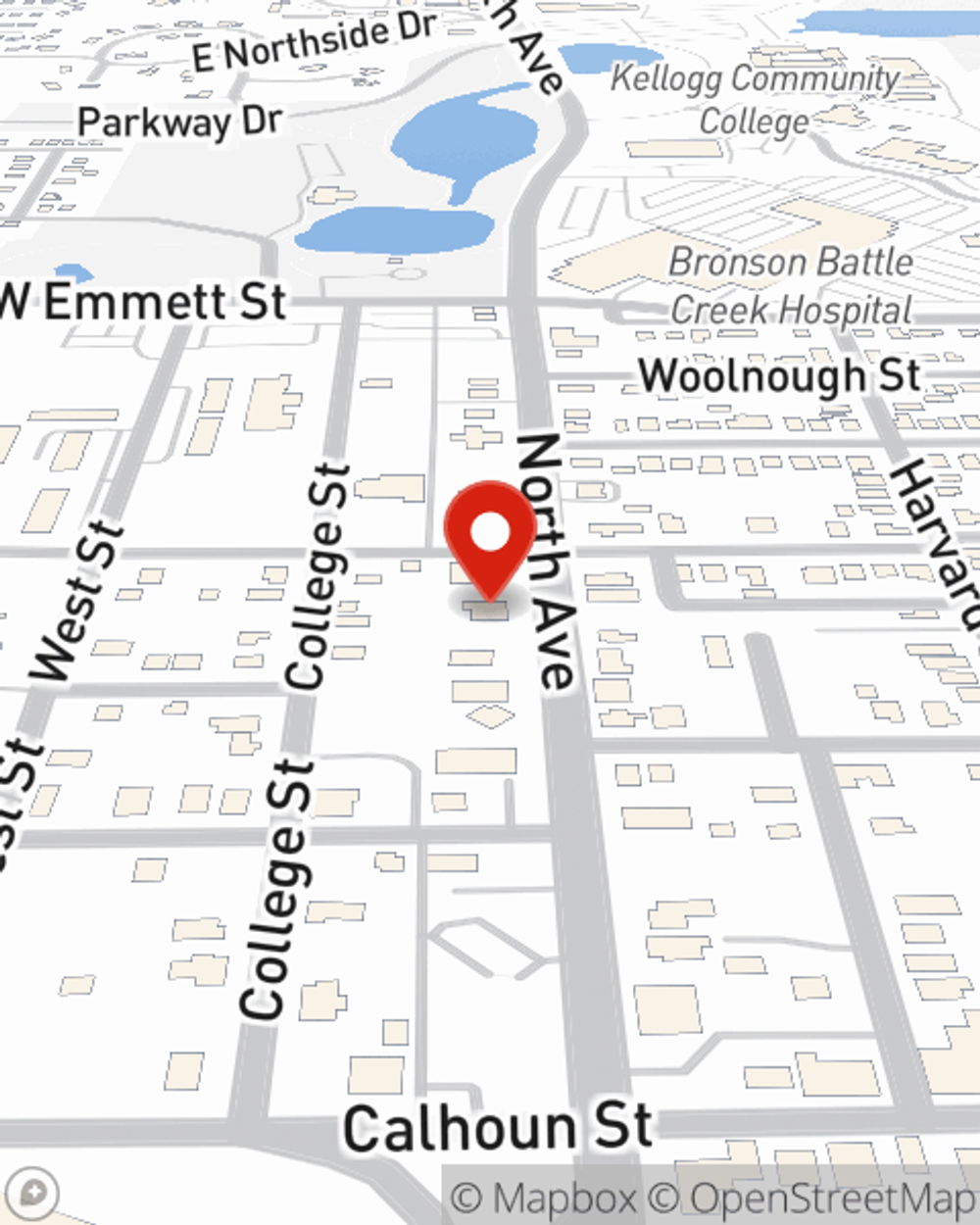

Life Insurance in and around Battle Creek

Protection for those you care about

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

Investing in those you love is what keeps you going every day. You listen to their concerns go to work to provide for them, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Protection for those you care about

Life won't wait. Neither should you.

Life Insurance Options To Fit Your Needs

Some of your options with State Farm include level or flexible payments with coverage designed to last a lifetime or coverage for a specific time frame. But these options aren't the only reason to choose State Farm. Agent Chad Heeter's wonderful customer service is what makes Chad Heeter a great asset in helping you pick the right policy.

Simply get in touch with State Farm agent Chad Heeter's office today to check out how the State Farm brand can help protect your loved ones.

Have More Questions About Life Insurance?

Call Chad at (269) 968-8177 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Chad Heeter

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.