Business Insurance in and around Battle Creek

Looking for protection for your business? Search no further than State Farm agent Chad Heeter!

No funny business here

Coverage With State Farm Can Help Your Small Business.

You've put a lot of elbow grease into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a veterinarian, a confectionary, a tailoring service, or other.

Looking for protection for your business? Search no further than State Farm agent Chad Heeter!

No funny business here

Keep Your Business Secure

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for artisan and service contractors, worker’s compensation or business owners policies.

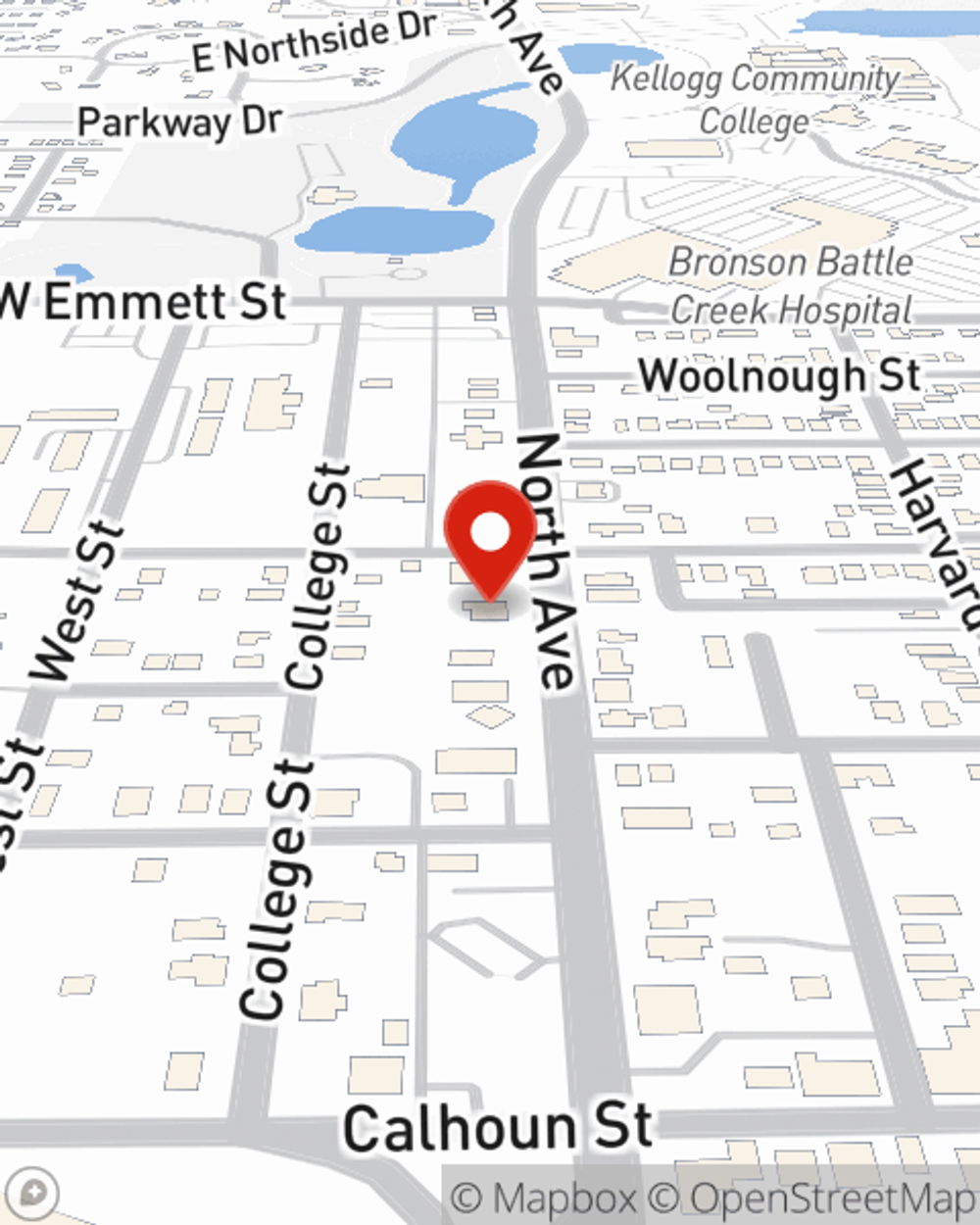

The right coverages can help keep your business safe. Consider contacting State Farm agent Chad Heeter's office today to review your options and get started!

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Chad Heeter

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.